“How We Help You Keep More of What You Earn”

We help you avoid these:

Most people follow the crowd – contributing to 401(k)s or IRAs, crossing their fingers, and hoping for the best. But what they don’t see are the hidden costs: market risk, management fees, and future tax traps.

There’s a Better Way!!!

Let me show you how to grow and protect your money — with control, flexibility, and security

Traditional Approach

- ✔ Tax-Deferred (pay taxes later at unknown rates)

- ✔ Exposed to Market Volatility

- ✔ 1–2% Management Fees Every Year

- ✔ Early withdrawal penalties

- ✔ Generic advice based on group plans

Strategic Approach (Our Method)

- ✔ Tax-Free Growth & Access

- ✔ Principal-Protected Strategies

- ✔ No Advisory or Management Fees

- ✔ Liquidity with No Age Restrictions

- ✔ Customized Solutions Built Around You

THE RESULT….

Is This Right for You?

This isn’t a one-size-fits-all plan. It’s a customized strategy built around your goals, your stage of life, and your financial future.

🤔 Who Can Benefit From ERFT

- You’re in your 40s, 50s, or early 60s and want to retire with peace of mind

-

You’re tired of watching your 401(k) ride the market rollercoaster

-

You’ve saved money but worry about taxes eating into your retirement

-

You want more control, more security, and fewer surprises

🔎 Why Haven’t I Heard This Before?

As many people out there that haven’t heard of Tax-Free Options, there are a ton of people that have and are actively utilizing them. These really aren’t new concepts. They’ve been around since the late 90s and have continued to evolve for the better.

Most traditional advisors stick to conventional tools like 401(k)s, IRAs, and mutual funds. We focus on the side of finance that eliminates risks, fees, and taxes, using strategies the top 1% have used for decades, and make them accessible to everyday families.

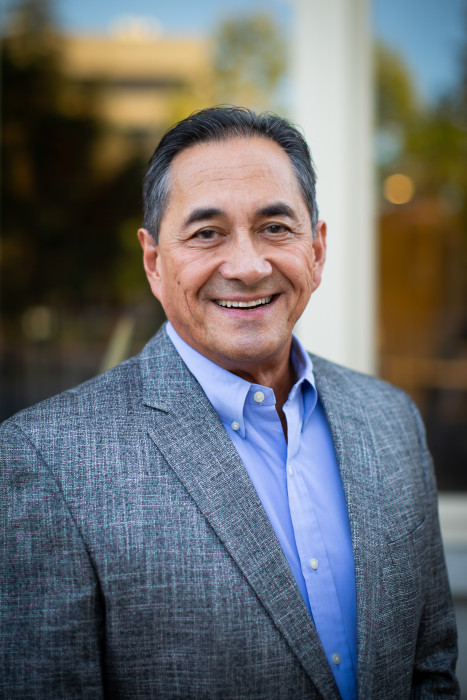

About Me

Tony Olibas

Building Strong, Tax-Efficient Financial Foundations for a Secure Future

Tony Olibas’ journey into the world of retirement planning began with a personal tragedy—the experience of watching his grandmother retire only to face financial insecurity, struggling to get by on Social Security. After witnessing her hardship, Tony realized the lack of proper retirement planning education, and this became his motivation to learn more and help others avoid the same fate.

With over 30 years in the corporate world, Tony transitioned to financial services, focusing on educating individuals nearing retirement about tax-efficient savings and investment strategies. His core values—honesty, trust, and integrity—drive his business and shape his relationships with clients. By listening attentively and understanding each client’s goals, he creates tailored strategies to ensure a peaceful and secure retirement, free from the uncertainty many face. Tony believes that true success lies not in the numbers, but in the lives changed by his guidance.

OUR SERVICES

When you think about your future, it’s important to focus on what truly matters to you. Whether it’s planning for a comfortable retirement, minimizing tax burdens, protecting your assets, or identifying potential risks — each of these pieces plays a key role in your overall financial picture. Taking the time to thoughtfully address these areas helps you build a solid, personalized path toward a future that reflects your goals, values, and peace of mind.

Testimonials

Not Just Clients – Lifelong Relationships

Frequently Asked Questions